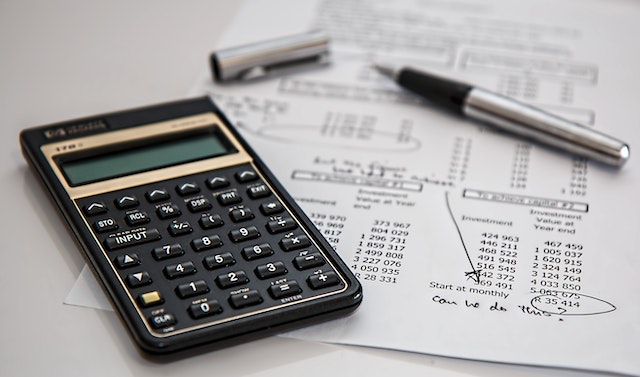

Accounting

What is accounting?

Accounting is "the system of recording and summarizing business and financial transactions and analyzing, verifying, and reporting the results" (as defined by Merriam-Webster.com).

WHY is ACCOUNTING ESSENTIAL?

What is the purpose of doing business if you do not maximize the results of your business potential? Not accounting for your business activities results in a lack of available information on which to base decisions. Decisions, for good or bad, bring their results and in some instances a bad decision could lead to the collapse of a business enterprise and thus resulting in the collapse of a support structure which might be feeding your family and the families of your employees, if you have any.

Besides that, not accounting, can be very expensive. If your business is running through the vehicle of a private company, a close corporation or any other company registered with the Companies and Intellectual Commission ("CIPC") which is subject to the Companies Act 2008, the director or member of the company or close corporation could end up in trouble with the authorities. It is a requirement of law, that proper accounting be performed by a company and that annual financial statements be prepared within 6 months after its financial year end, and in certain cases these annual financial must also be independently reviewed or externally audited.

If you want to find out more on how to determine whether or not your company or close corporation must have it's annual financial statements independently reviewed or externally audited in terms of the law, click here.

What about CLOSE CORPORATIONS?

"The Companies Act, 2008 has changed the regulatory framework applicable to close corporations. The requirements of the Companies Act to calculate the public interest score to determine whether the company is required to be audited is now also applicable to a close corporation. Close corporations meeting the requirements to be audited would also need to apply the Financial Reporting Framework as set out in the Companies Regulations." - https://www.saica.org.za/resources/legislation-and-governance/close-corporations-act

What about TRUSTS?

"A trustee shall, at the written request of the Master, account to the Master to his satisfaction and in accordance with the Master's requirements for his administration and disposal of trust property and shall, at the written request of the Master, deliver to the Master any book, record, account or document relating to his administration or disposal of the trust property and shall to the best of his ability answer honestly and truthfully any question put to him by the Master in connection with the administration and disposal of the trust property." - Trust Property Control Act 57 of 1988.

What about BODY CORPORATES?

"A body corporate must... keep proper books of accounts" and an "audit of a body corporate’s annual financial statements...must be carried out..." - Sectional Title Schemes Management Act 8 of 2011 Regulations.

What about sole proprietors?

As for sole proprietors and freelancers, the law is not as imposing of stringent requirements, yet they still have to account for their business affairs and report the balances of their personal assets and liabilities as well their business or trading performance results to the South African Revenue Services (SARS) at each tax year end. They must also be prepared for a possible verification or audit which might be imposed on them by SARS. A lack of proper accounting and supporting documentation could lead to negative tax consequences for a sole proprietor and a freelancer alike.

HOW CAN WE HELP YOU?

We can assist you in getting the accounting done and where required we can also assist you in preparing the annual financial statements and getting them audited or independently reviewed if needed.

PRICING for SERVICE packages

START-UP

R500

R450

Per Month

ADVANCED BUSINESS

R1,200

R950

Per Month

VALUE ADDED BUSiNESS

R2,200

R2,000

Per Month

WANT TO JOIN NOW?

JOIN NOW

for serivce

Please fill in your details below

* Required field